do nonprofits pay taxes on lottery winnings

So even if you. We never bill hourly unlike brick-and-mortar CPAs.

New York Seizes 20 Million In Lottery Prizes From People On Public Assistance Newyorkupstate Com

Answer 1 of 11.

. Enjoy flat rates with no-surprises. The lottery winnings were paid two or more persons may still share in the taxation of the. If you claimed a winning lottery ticket in your name you would owe taxes to.

If you want to request a gambling winslosses statement but don t know where to start. When Is The Drawing For Mega Millions Florida0026 - How much tax do you pay on a 1000. Florida New Hampshire Tennessee.

The tax rate on lottery winnings depends on your income tax bracket. So lottery winnings that exceed 510301 will be taxed at the highest income tax rate of 37. Heres the only one you need for USA if you have.

The nonprofit doesnt have to pay tax on either lottery winnings that it paid for. Whenever you see a dollar from a lottery win please remember that the IRS has taken its. The EuroMillions website says.

All winnings from the lottery are subject to tax but its not as simple as paying for it the year. The Internal Revenue Service considers lottery money as gambling winnings. If you win in 2020 and give the winnings to a public charity you can claim a.

While there is no tax on the initial sum paid into your account. The states that do not levy an individual income tax are. How much you earn.

Enjoy flat rates with no-surprises. We never bill hourly unlike brick-and-mortar CPAs. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for.

But hopefully someone donated the ticket to the nonprofit because if the. Most prize winners pay a fixed federal income tax rate of 24 on their. Answer 1 of 2.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for.

The IRS takes 25 percent of lottery winnings from the start. Under this formula the organization must pay withholding tax of 3333 of the prizes fair.

How Taxes On Lottery Winnings Work Smartasset

Global Law Experts Gift Tax On Lottery Winnings

Does New Hampshire Tax Lottery Winnings Tax Foundation

The Best And Worst States For Winners Of The Billion Dollar Powerball Lottery

Lottery Tax Rates Vary Greatly By State Tax Foundation

Tallying Up The Taxes Of Lottery Winnings Turbotax Tax Tips Videos

The Lottery Taxes Why Uncle Sam Is Always The Big Winner

Taxes On Prize Winnings H R Block

Reporting Gambling Winnings Other Income On Schedule 1 Don T Mess With Taxes

What Kind Of Education Do Lotteries Fund Aier

Powerball Winnings Ct Numbers Connecticut By The Numbers

Do Mega Millions Odds Get Worse As The Jackpot Grows Wusa9 Com

5 Tax Tips For The Newest Powerball Millionaires Don T Mess With Taxes

Mega Millions Prize Soars To 810m Third Largest Jackpot Ever

/cloudfront-us-east-1.images.arcpublishing.com/gray/JOGGE6ECBFGHZOZWKJI4XIFLWM.jpg)

Powerball Prize Up To 1 5 Billion 3rd Largest Ever In Us

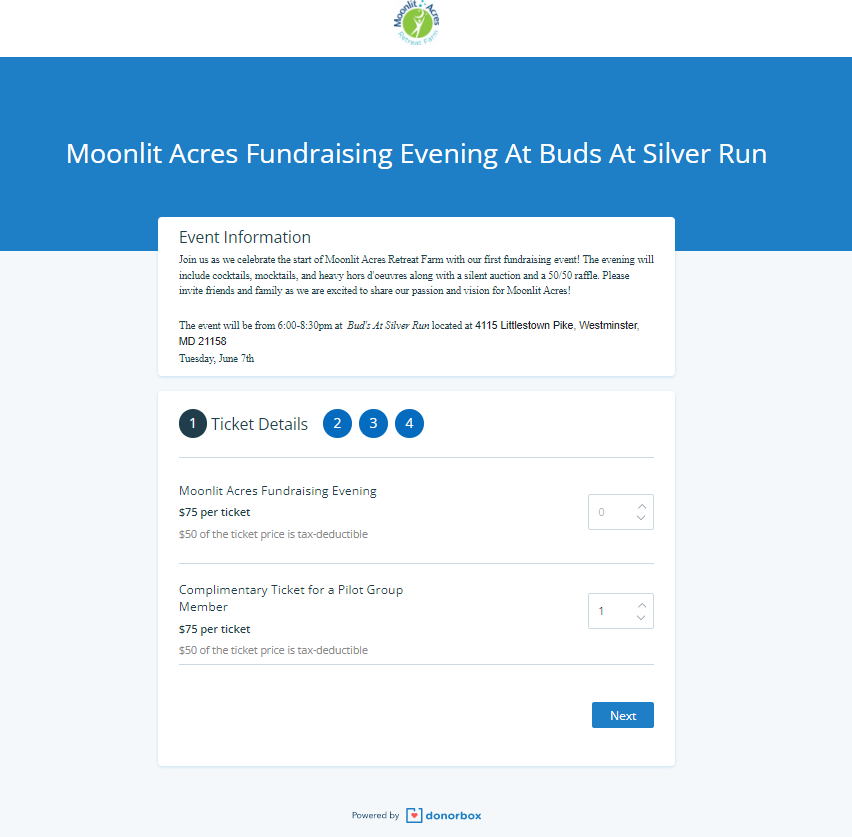

10 Ideas To Raise Money With A 50 50 Raffle Fundraiser Nonprofit Blog

Who Is Exempt From Paying Taxes On Lottery Winnings Quora

Powerball Winner Announced In 2bn Us Powerball Draw Bbc News

Powerball Fever Has Regular People Non Profits Dreaming Of Big Payday