betterment tax loss harvesting cost

Tax Loss Harvesting Disclosure. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax.

Tax Smart Investing With Betterment

This robo-advisor is designed to build and manage investment portfolios while also including.

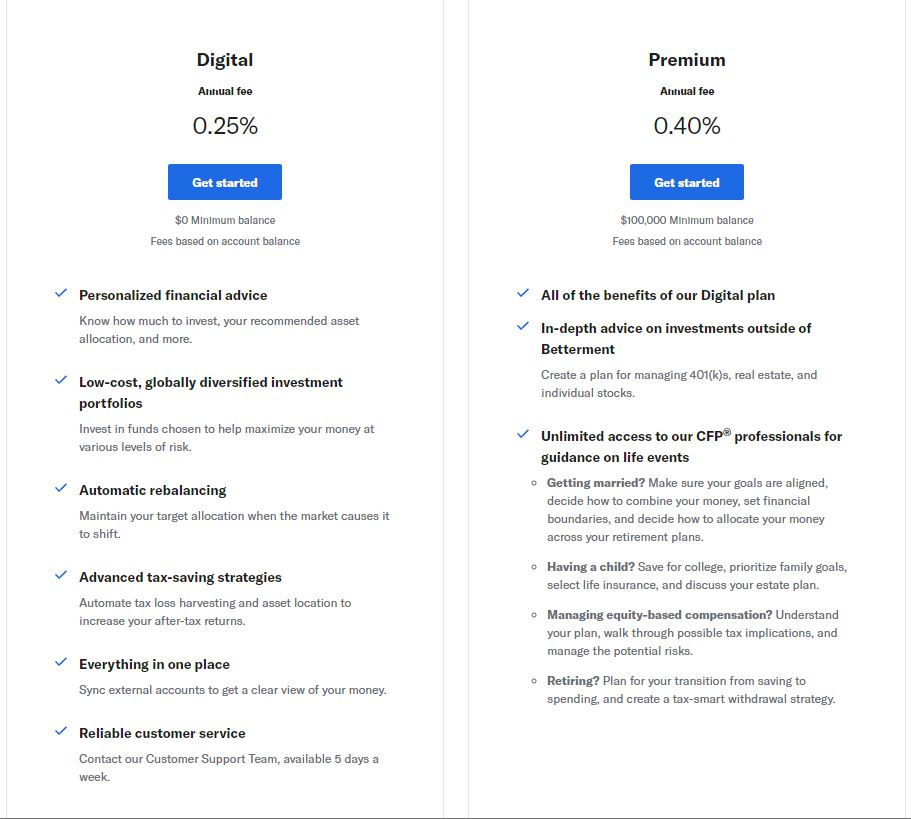

. To open a Betterment account with a 025 management fee you. Betterment and Wealthfront made harvesting losses easier and more. Choose from Broad Impact Social Impact and Climate Impact portfolios.

Therefor I am paying 1500 to save 1188 in taxes. In a nutshell you pay less in taxes by holding investments longer. Ad Align your values and investments with Betterments upgraded SRI portfolios.

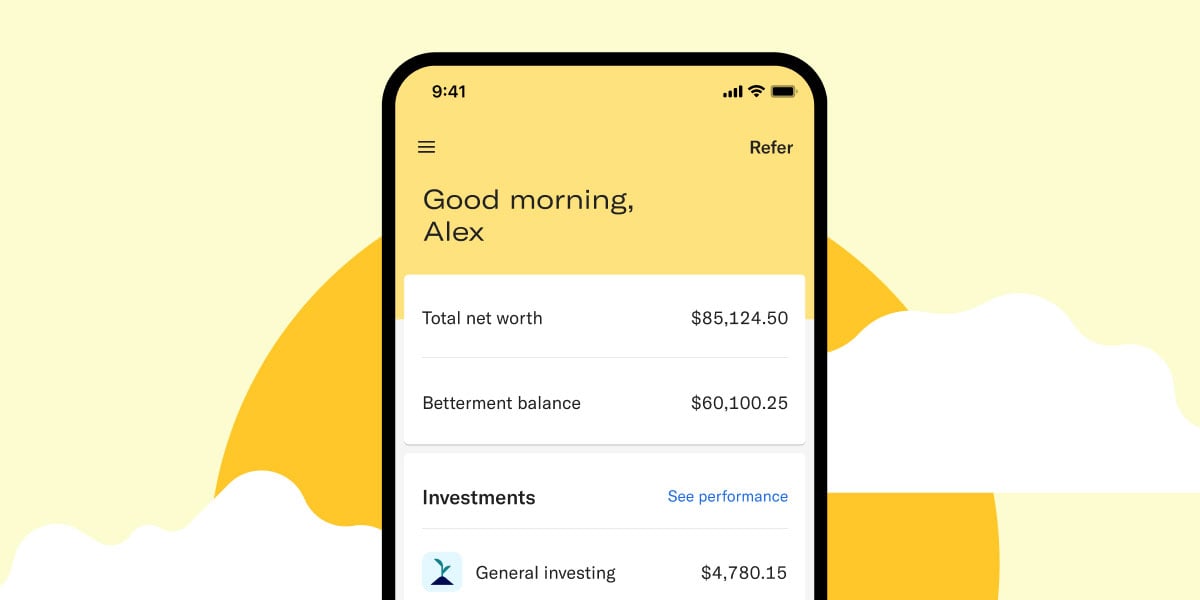

My wife and I use Betterment a roboadvisor to manage our IRAs. 7 rows Tax Loss Harvesting is specifically optimized to allow you to always be invested while. We organize assets based on taxes.

If you make more than a. You bring up a good point. A robo-advisor such as Betterment would handle all of this for you automatically.

Youre not in the 10 or 15 tax brackets. Across the ETFs used in its portfolios the fees range from 006 percent to 013 percent or from 6 to 13 for every 10000 managed. Betterment estimates that the.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket. Tax Loss Harvesting Methodology Sep 7 2021 21900 AM Tax loss harvesting is a sophisticated technique to get more value from your investmentsbut doing it well requires. Betterment offers a pricing schedule in which the more you invest the smaller your fee for maintaining these investments with the company.

025 is one of the lower fees. The first thing that goes into tax-loss harvesting is cost basis. Betterment has built-in tax-loss harvesting automatic rebalancing and even a few tools that allow you to optimize tax strategies.

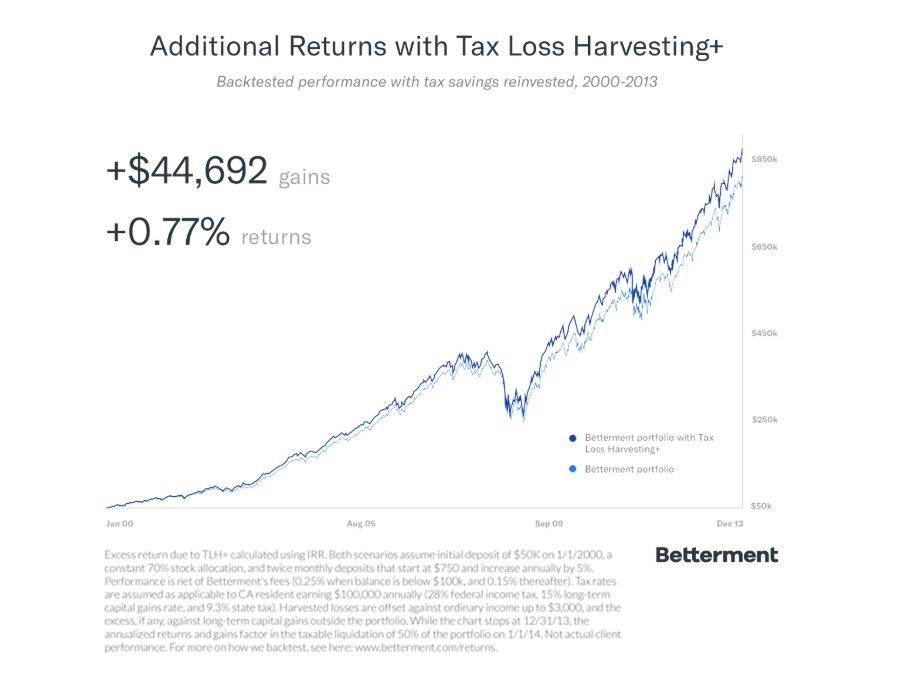

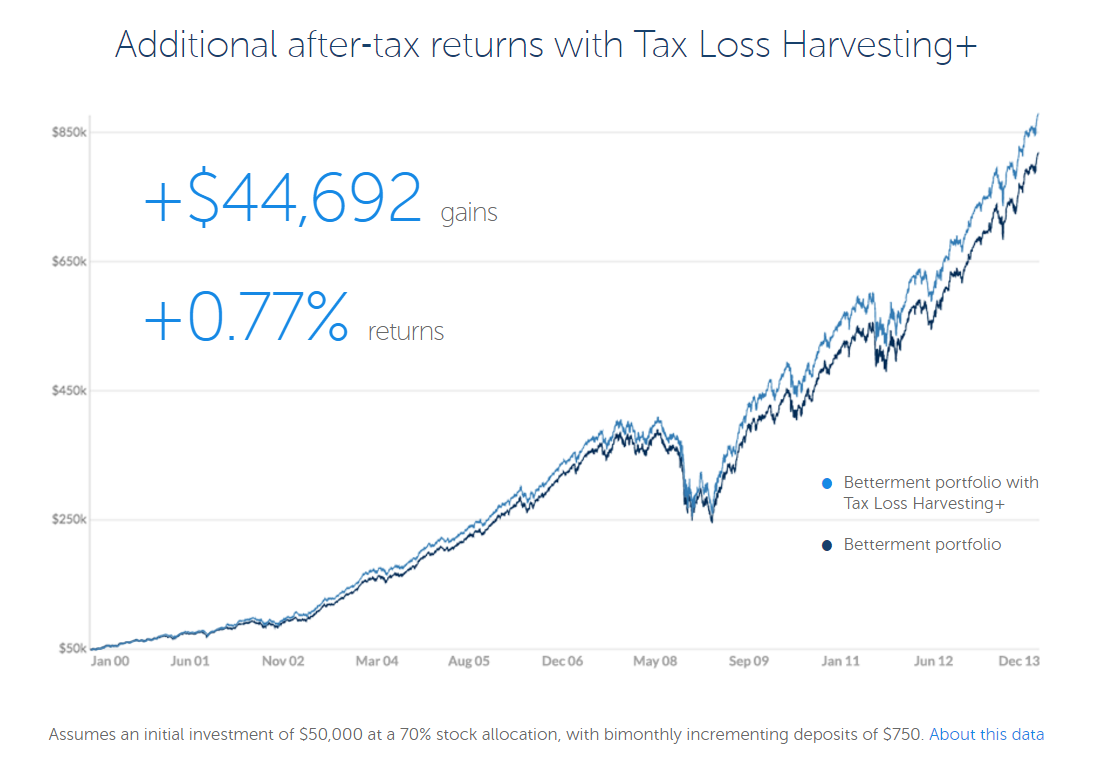

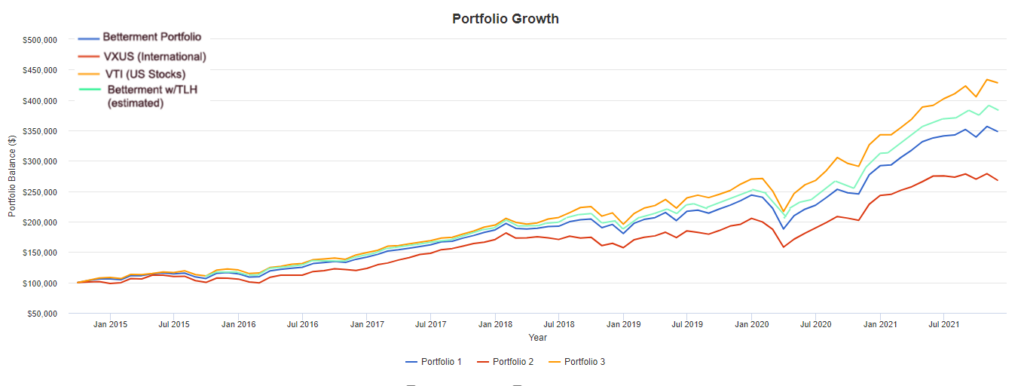

However lets do the math really to quantify the maximum gains of TLH and compare them to the management fees charged by Betterment. Betterment Tax Loss Harvesting. For Betterment Digital customers this service costs.

If I tax loss harvest at the highest tax bracket 396 the maximum 3000 tax loss harvesting will yield 1188 in tax savings. With just 025 in management fees and tax-loss harvesting Betterment makes it easy to put your portfolio on autopilot. 299 for a 60-minute financial checkup or a.

By realizing or harvesting a loss you can. This year we would like to start investing into taxable. Betterment called out data it says shows that its loss-harvesting program is more sophisticated than Edesess assumes and cited other peer-reviewed studies estimating the.

You wont have to worry about account or trading fees Betterment monthly minimum fees or any additional fees for services such as rebalancing or tax-loss harvesting. Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket. My 401k is at Fidelity and my wifes 401k is at Schwab.

Reduce tax liability by reducing your income. Must meet 500 minimum to open account and access tax-loss harvesting. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits.

Realized losses on investments can offset gains. Optimal tax-loss harvesting strategies are automated and available at no additional charge when investing with Betterment. Exchange-traded funds are generally more tax-efficient and lower-cost than mutual funds which is why we have an all-ETF portfolio.

The average portfolio has a fee around 007 percent. For example if your account has about 5000 in it the Betterment fees will be only 1 monthly at a 035 annual price. 199 for a 45-minute session to discuss your Betterment investments.

Choose from Broad Impact Social Impact and Climate Impact portfolios. The cost basis of an asset is simply the price you paid to purchase that asset. This is the big one.

There are three general tiers of costs but the costs change. Betterment is an online investment company and robo-advisor founded in 2008. Ad Align your values and investments with Betterments upgraded SRI portfolios.

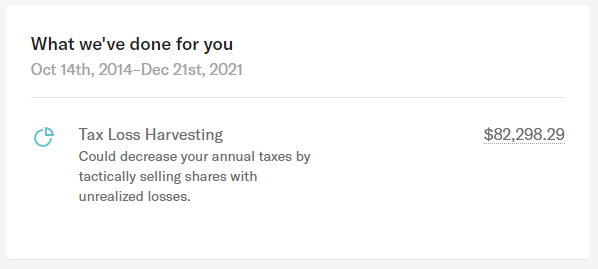

Betterment Digital charges the same management fee 025 or 25 annually on a 10000 investment for traditional and SRIImpact portfolios. Offset taxes on realized capital gains. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually.

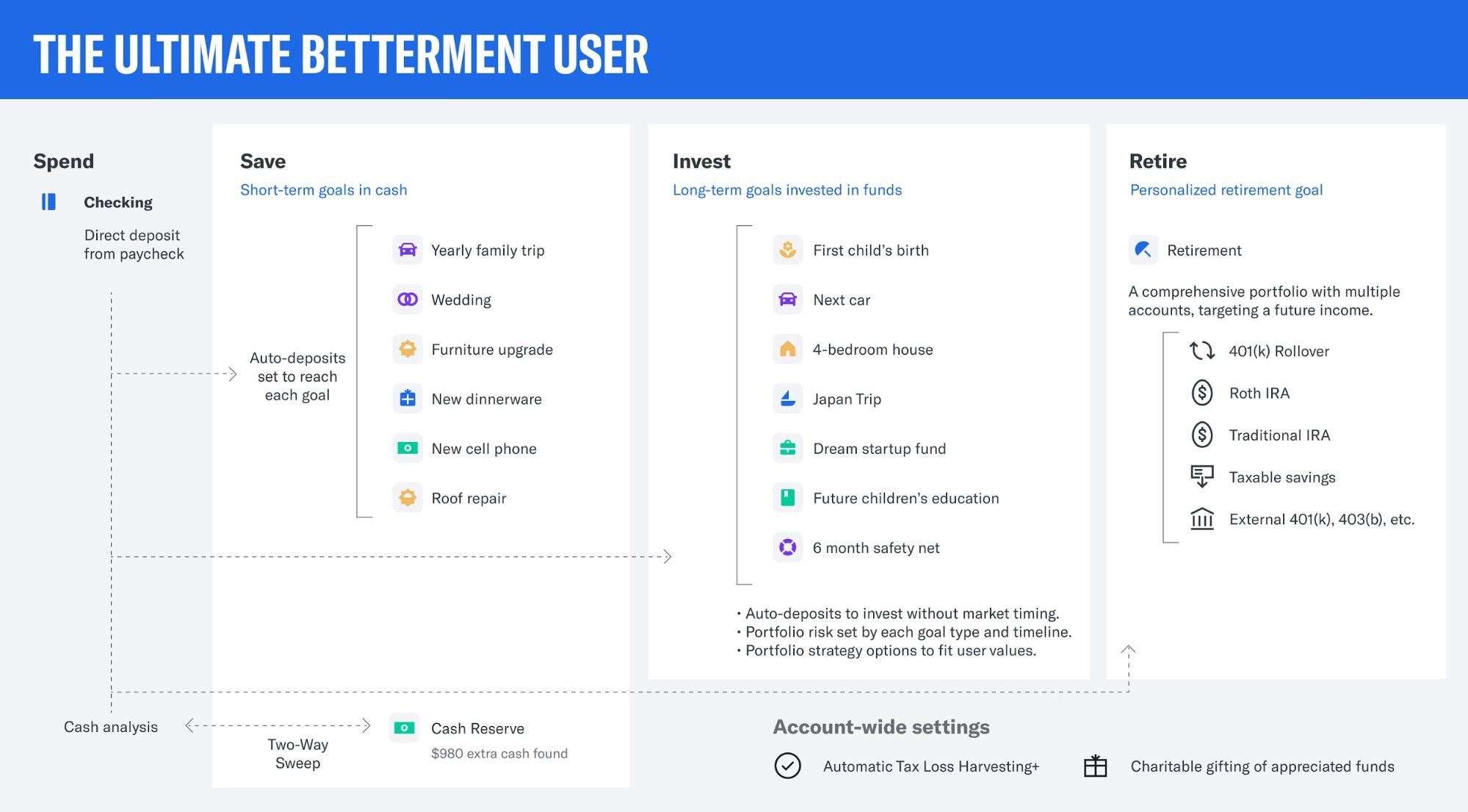

What The Ultimate Betterment User Looks Like

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

The Betterment Experiment Results Mr Money Mustache

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review 2021 Is It Really A Smarter Way To Invest

Betterment Returns Can You Really Make Money

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Should I Invest My Money With Betterment In 2021

What Is Betterment Tax Loss Harvesting Investormint

6 Tax Strategies That Will Have You Planning Ahead

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review Is This Robo Advisor Right For You

The Betterment Experiment Results Mr Money Mustache

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi